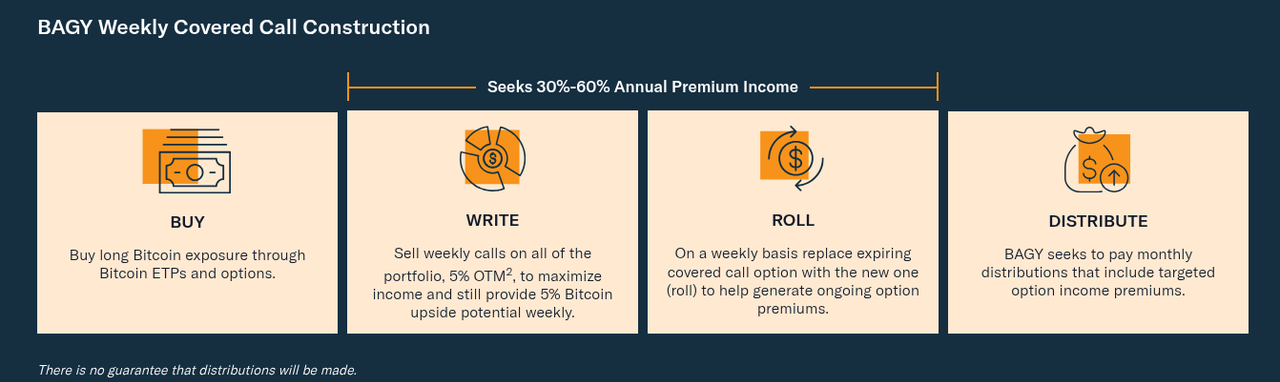

发现有几个bitcoin EFT都是这类,能到30%+的年度分红。

看了一下holding,基本是多腿短期期权+bill。

不知道这类ETF的risk大不大。我的理解是多腿credit期权正确操作的话,损失和收益都是capped,相对安全。

但是看了几个都是小公司在做,管理总资产才几个B的,不知道为啥没有大玩家。

自己最近一个月做单腿income generation 期权收益大概3%,但是如果UL乱变就不知道如何操作了。

这类EFT如果风险可控,比自己做要省心很多。

基于期权交易的超高分红ETF能买吗?

版主: 牛河梁, alexwlt1024

#2 Re: 基于期权交易的超高分红ETF能买吗?

另外还有些每周分红的热门股票ETF,不是靠option挣钱。感觉很risky。

The Roundhill NVDA WeeklyPay™ ETF (“NVDW”) is designed for investors seeking a combination of income and growth potential. NVDW aims to provide weekly distributions and calendar week returns, before fees and expenses, equal to 1.2 times (120%) the calendar week total return of Nvidia common shares (Nasdaq: NVDA). NVDW is an actively-managed ETF.

There is no guarantee that the Fund will successfully provide returns that correspond to approximately 1.2 times (120%) the calendar week total return of common shares of NVDA. An investment in the Fund is not an investment in the underlying stock.

Do Roundhill WeeklyPay™ ETFs sell options?

No, Roundhill WeeklyPay™ ETFs do not sell options. Instead, the Funds offer uncapped, levered upside to their underlying Reference Assets.

The Roundhill NVDA WeeklyPay™ ETF (“NVDW”) is designed for investors seeking a combination of income and growth potential. NVDW aims to provide weekly distributions and calendar week returns, before fees and expenses, equal to 1.2 times (120%) the calendar week total return of Nvidia common shares (Nasdaq: NVDA). NVDW is an actively-managed ETF.

There is no guarantee that the Fund will successfully provide returns that correspond to approximately 1.2 times (120%) the calendar week total return of common shares of NVDA. An investment in the Fund is not an investment in the underlying stock.

Do Roundhill WeeklyPay™ ETFs sell options?

No, Roundhill WeeklyPay™ ETFs do not sell options. Instead, the Funds offer uncapped, levered upside to their underlying Reference Assets.