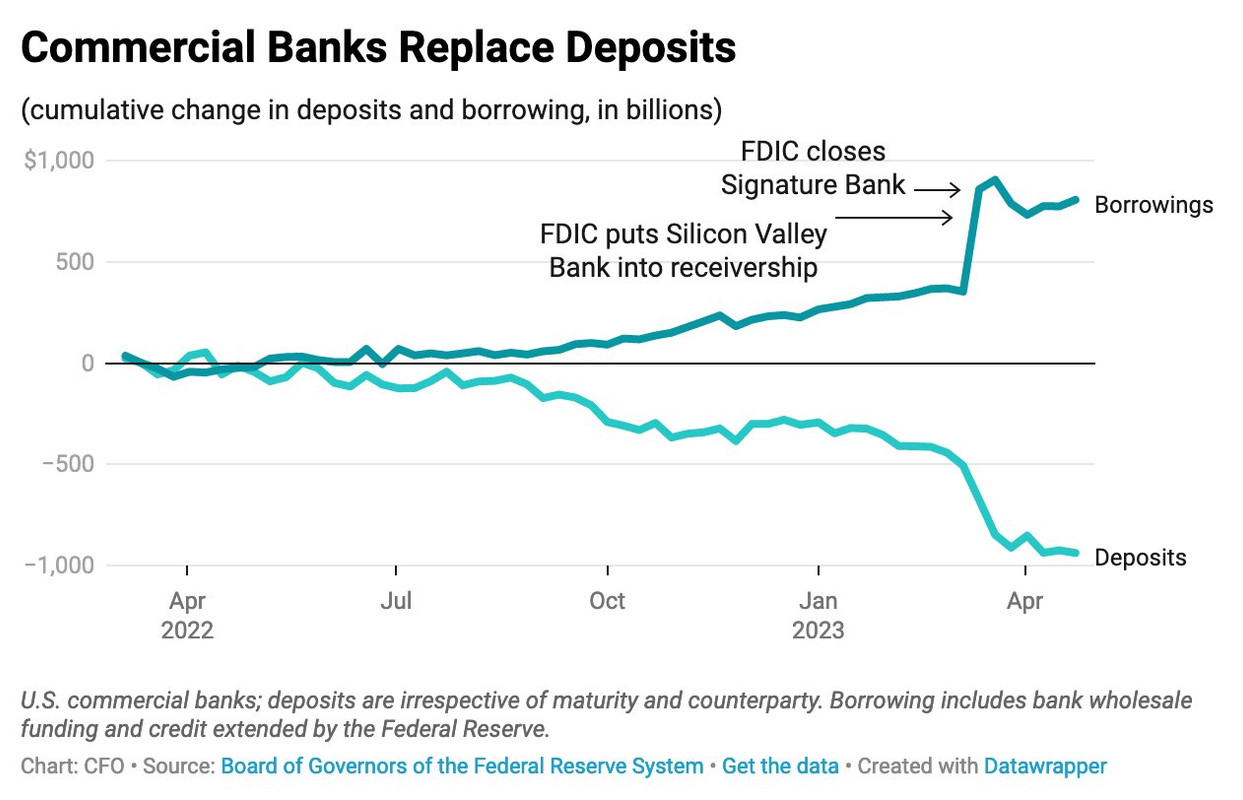

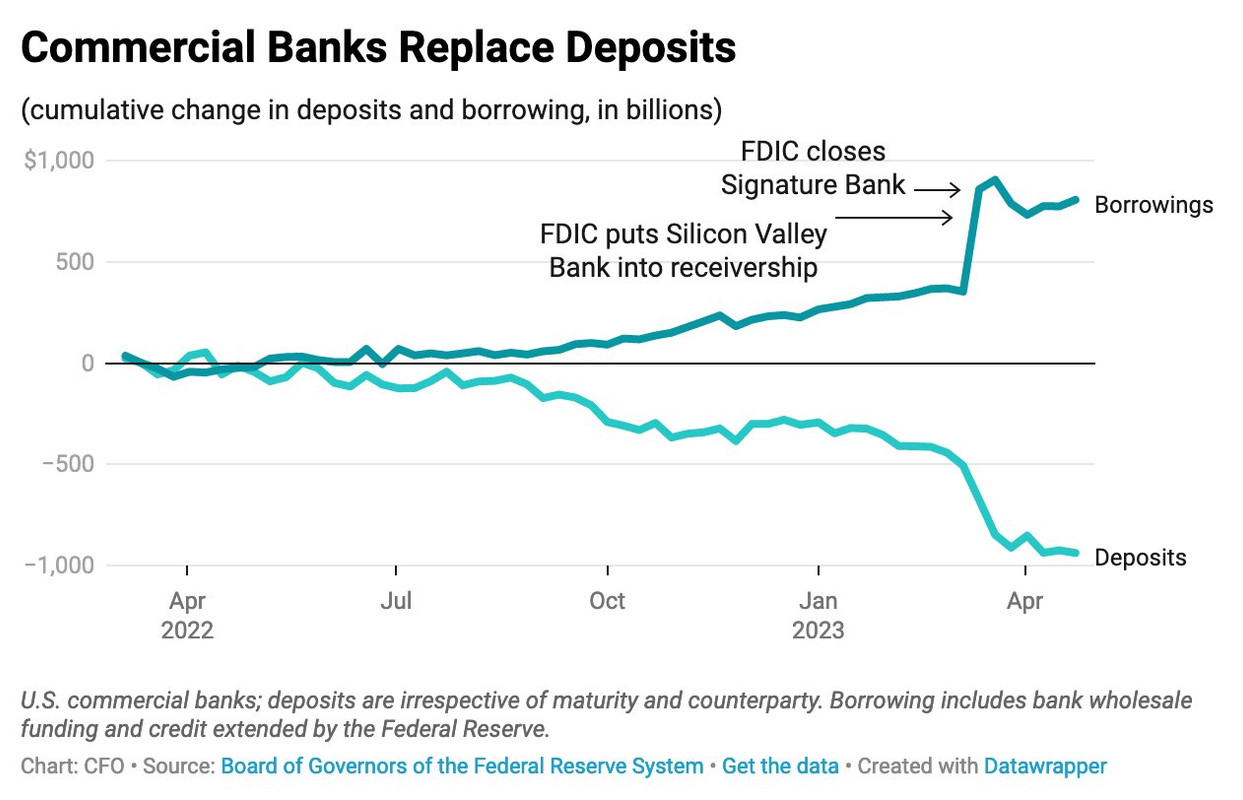

US Banks lose a TRILLION dollars in deposits, replace with borrowings

The first bad news is that 50% of the US banks have more liabilities than assets. But here comes more...

One may say now that deposits are liabilities as well as borrowings. However, that one should look at where those money come from.

In general, banks receive deposits, and give loans using those deposits. They earn interest rates with loans and pay a portion of the profit as rewards to depositors.

To simplify, let's ignore the FED funding, bonds and investments - there are multiple ways to create a cashflow.

The new borrowings come from the funding and credit lines by the Federal Reserve. Lacking the people's money, banks have to replace them to have enough liquidity in order to provide loans and keep earning their interest.

If you compare an average APY (annual percentage yield) the banks offer for savings with the current FED rate, you will have this: 0.25% VS 5.25%.

So, one can see that borrowing from people is 21 TIMES CHEAPER than from the FED.

Where does it lead?

First - rising interest rates for loans, which currently are 10-32% for personal loans and about 7% for mortgages, both at average.

Second - lacking diversification of the liquidity sources. If the banks rely on the State more, then they accordingly are more dependent on the the State.

Given the situation with the recession being predicted, debt ceiling and other macroeconomic problems like investment uncertainty and international trade changes, etc., even a relatively small crisis situation may lead to the big shakes.

And one more thing to think about!

If it happens that banks are no longer intermediaries between the people, helping them to connect and get what they need... And if they now just take money from the State (printed by the FED or tax money one already paid - doesn't matter) to give them as loans earning additional interest that is higher than before...

Then why that one would need those banks?

Global central banks to increase gold share in their FX reserves

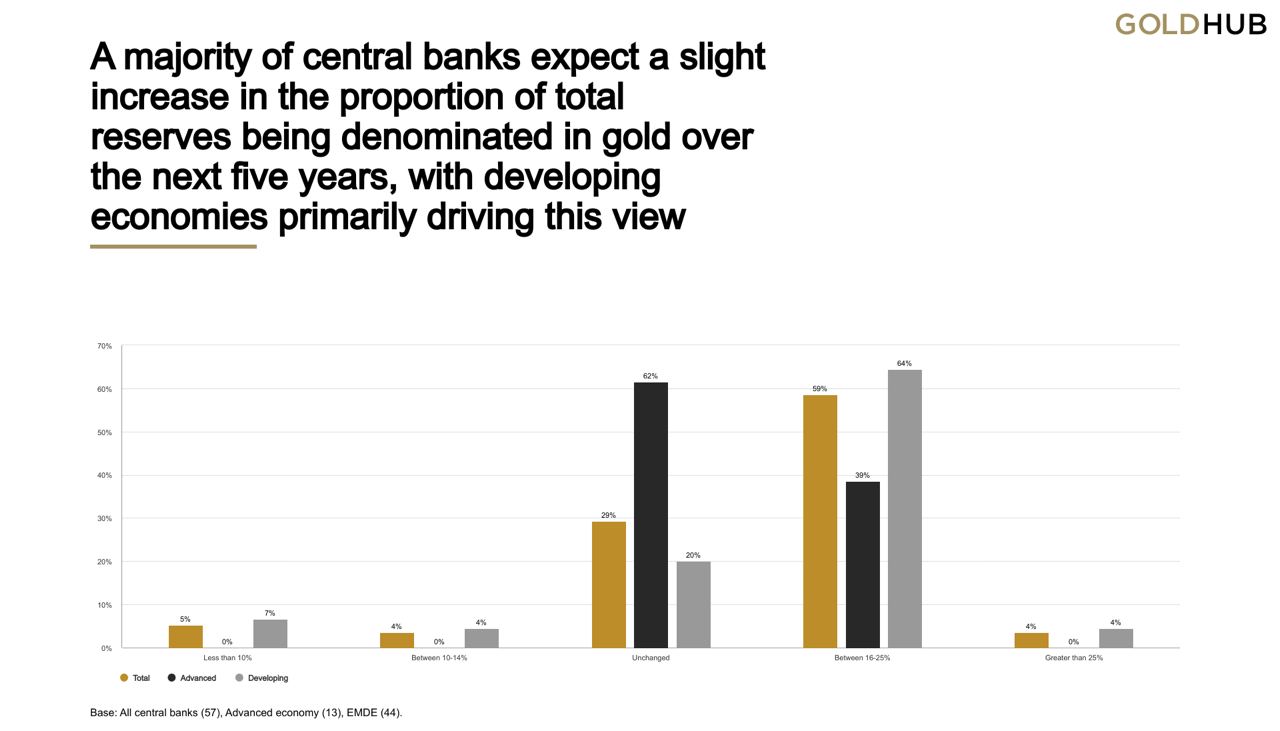

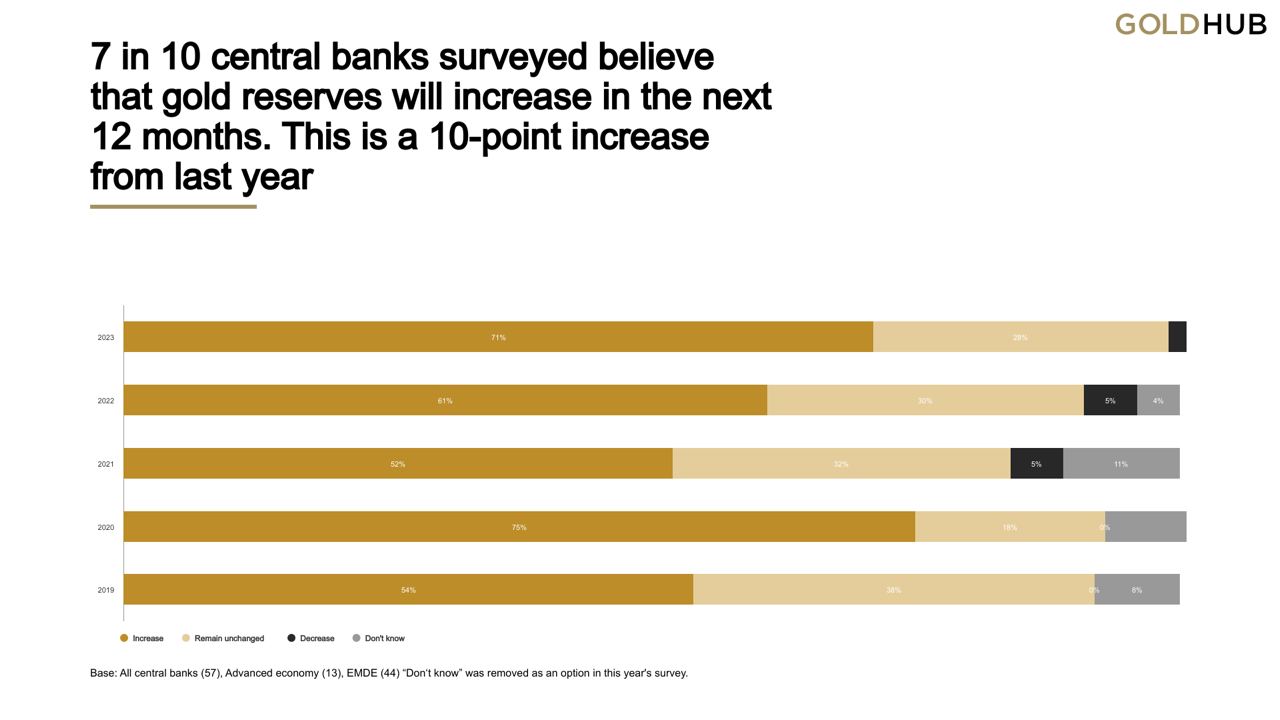

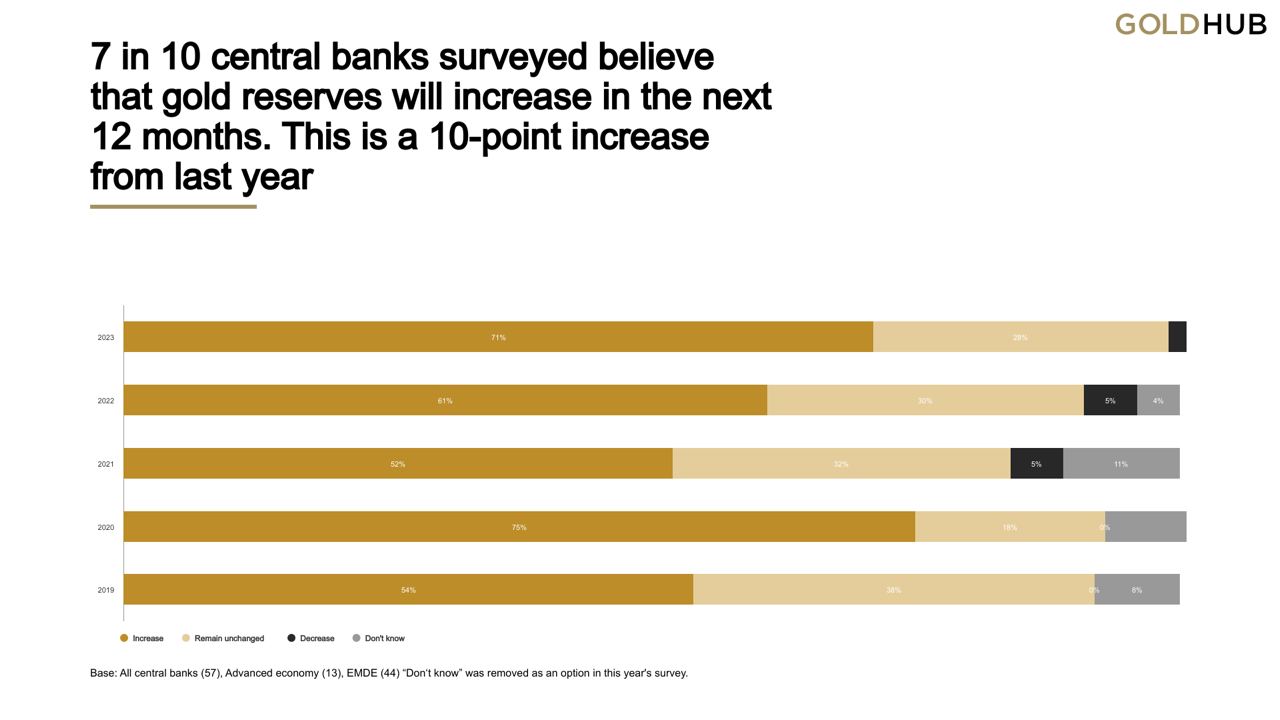

Following historically high levels of gold purchases by global central banks, they continue to view gold positively, with plans to increase the share of gold in their foreign exchange reserves, the 2023 Goldhub survey found.

The survey revealed that 24% of central banks intend to increase their holding reserves in the next 12 months.

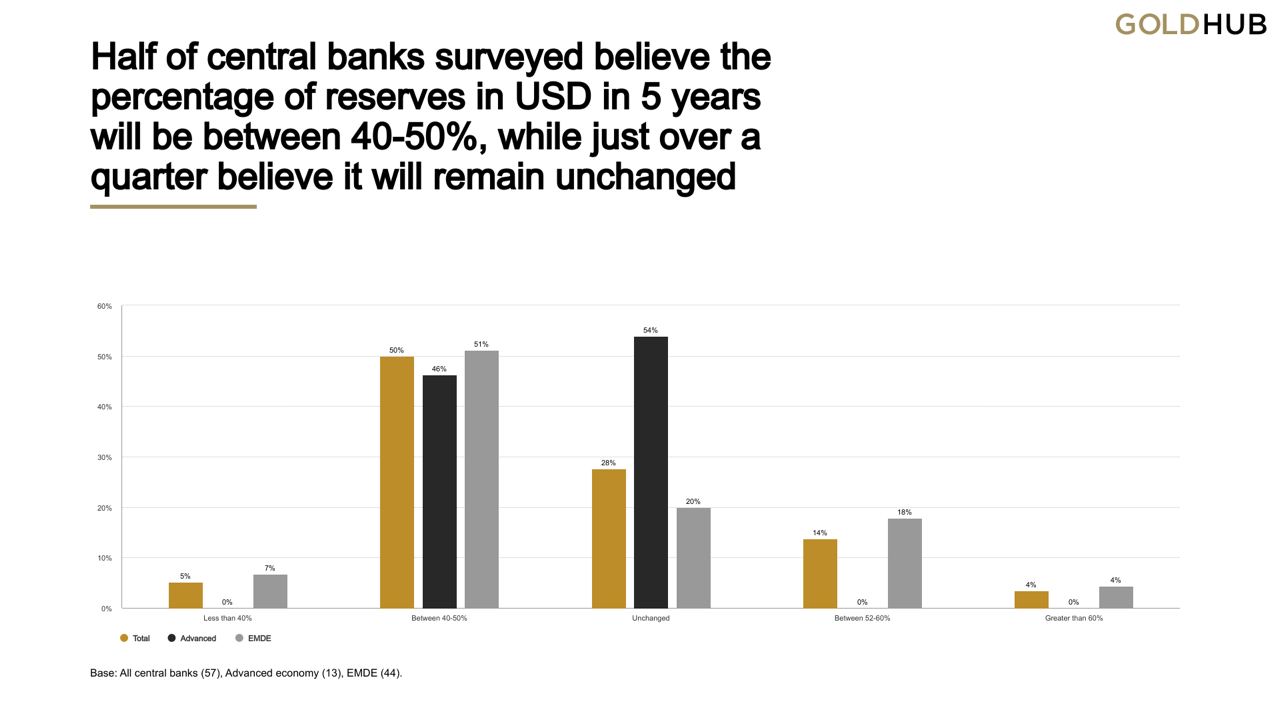

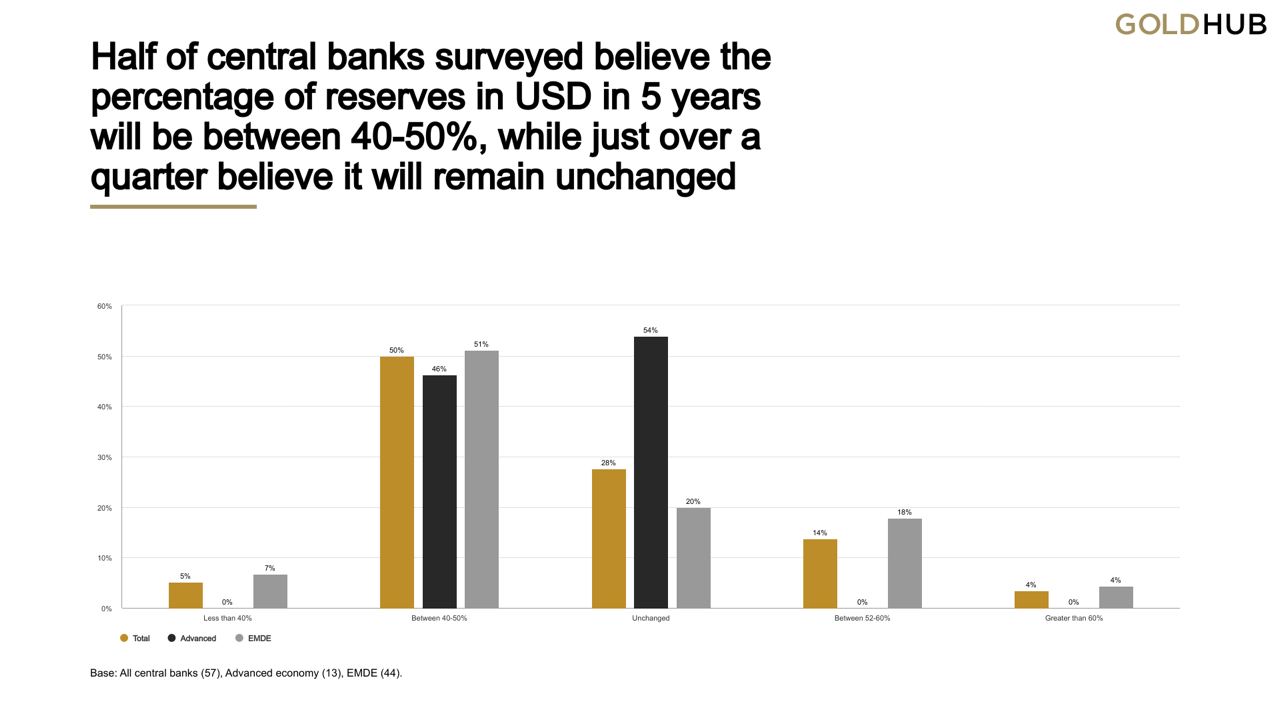

Furthermore, central banks' views towards the future role of the US dollar were more pessimistic than in previous surveys.

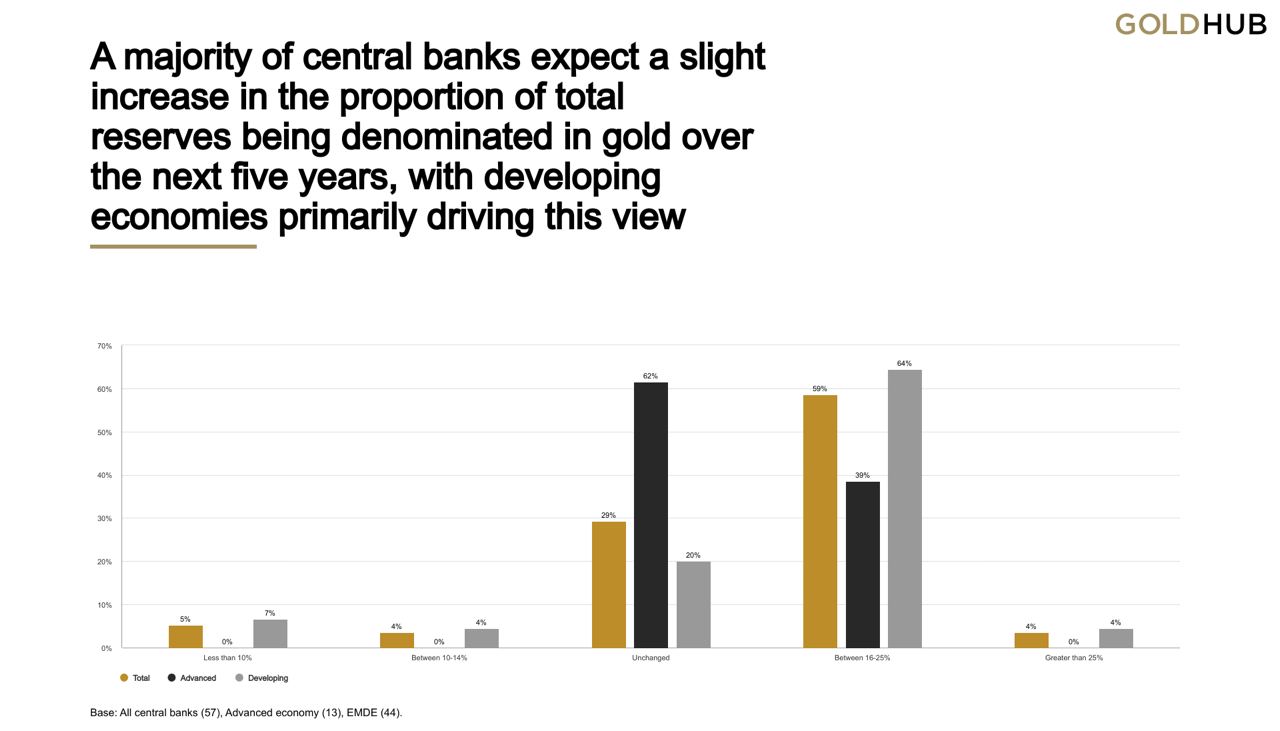

By contrast, their views towards gold's future role grew more optimistic, with 62% saying that gold will have a greater share of total reserves compared to 46% last year.

Earlier, the World Gold Council (WGC) reported that in 2022, global demand for gold increased by 18% compared to 2021, to 4,741 tons – the highest since 2011.

According to the WGC, this was mostly driven by the huge demand for gold by central banks, which in 2022 totaled 1,136 tons. This is also the highest level of gold purchases since 1967.