China is waking up from its property nightmare

版主: Softfist

-

一紙荒唐(阿糖)楼主

- 论坛精英

- 帖子互动: 395

- 帖子: 6929

- 注册时间: 2025年 2月 8日 09:23

- 来自: 没能耐就说没能耐,什么叫大环境不好?你到哪哪大环境不好,你是破坏大环境的人啊? -赵本山

#1 China is waking up from its property nightmare

https://www.economist.com/china/2025/06 ... -nightmare

China is waking up from its property nightmare

An ecstatic $38m luxury-mansion auction lights up the market

Apartment blocks under construction in China.

Photograph: Getty Images

Jun 1st 2025|SHANGHAI

Save

Share

Give

Listen to this story

CHINA’S ECONOMY has been through a stress test in the past six months with the trade war shredding nerves. Tensions over tariffs are not over yet. On May 29th Scott Bessent, America’s treasury secretary, said that talks had “stalled”. President Donald Trump then exchanged accusations with China’s ministry of commerce about who had violated the agreement reached on May 12th to reduce duties. On June 4th, Mr Trump wrote on social media that President Xi Jinping was “extremely hard to make a deal with”. Yet even as the trade war staggers on, two things may be reassuring Mr Xi. One is that so far the economy has been resilient. Private-sector growth estimates for 2025 remain in the 4-5% range. The other is that one of China’s biggest economic nightmares seems to be ending: the savage property crunch.

To get a glimpse of that, consider a gated home in Shanghai’s Changning district. It has an air of traditional German architecture and a large front garden, a feature of the city’s most ritzy neighbourhoods. But what really stands out is the price. On May 27th the property sold for a stonking 270m yuan ($38m), creating a sensation in the Chinese press. At 500,000 yuan per square metre, it is one of the priciest home auctions in recent memory. That the wealthy are prepared to pony up such an exorbitant price is being interpreted as a sign that China’s huge and interminable property crisis might finally be ending.

Speculation about a turnaround has been building over dinner tables, in boardrooms and at state-planning symposiums. The excitement is hardly surprising. Property, broadly defined, contributed about 25% of GDP on the eve of its crash in 2020. It now represents 15% or less, showing how the slump has been a huge drag on GDP growth. The depressive impact of falling prices on ordinary folk is hard to overstate. In 2021, 80% of household wealth was tied up in real estate; that figure has fallen to around 70%. Hundreds of developers have gone bust, leaving a tangle of unpaid bills. The dampening of confidence helps explain sluggish consumer demand.

While the market is still falling, you can make a decent case for the first time since the start of the crisis that the end is in sight. In the first four months of 2025 sales of new homes by value fell by less than 3% compared with the year before. In 2024 the decline was 17%. Transactions will continue to drop only modestly this year, reckon analysts at S&P Global, a rating agency.

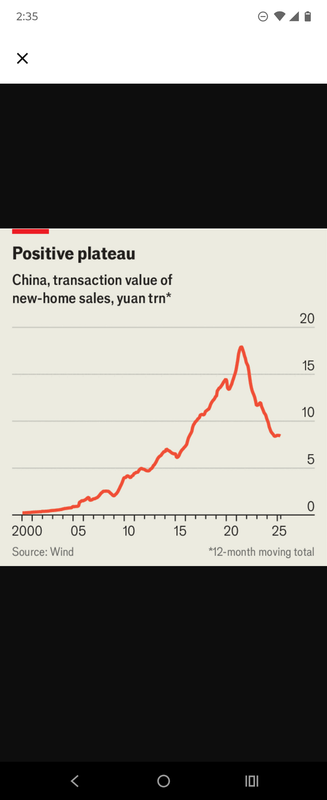

Chart: The Economist

One of the biggest problems was that millions of flats were built but never sold. Last year as many as 80m stood dormant. Now in the “tier-one” cities of Beijing, Shanghai, Guangzhou and Shenzhen, that problem is easing. At the end of January the inventory held by developers in those cities would have taken around twelve and a half months to shift at current sales rates, according to CRIC, a property data service. That is down from nearly 20 months in July 2024, and not far from the average of ten months in 2016-19 across the country’s 100 largest cities. In other words, the overhang is starting to look less terrifying.

Shanghai’s renaissance illustrates the trend. Transactions rose slightly each month from February to April compared with the year before, making it one of the few cities where prices have risen year on year for months in a row. It still has controls over who can buy properties and how many. But luxury homes are starting to be snapped up quickly, says Ms Fang, an estate agent. The prices of standard properties will probably continue to grow this year, she says, but the most expensive homes are increasing in value even faster.

Bottoms up

What explains the bottoming out? Partly, just the passage of time. The average housing crash takes four years to play out, according to a study by the IMF of house-price crashes from 1970 to 2003. Officials in Beijing started deflating the bubble by tightening developers’ access to credit in mid-2020 and investors started to panic about the solvency of the monster developers at the end of that year. But the government is also more determined than ever to put an end to the downturn. Local governments have been encouraged to buy unused land and excess housing with proceeds from special bonds. Some are handing out subsidies for buying homes. A plan to renovate shantytowns could create demand for 1m homes. The central bank cut interest rates in May, reducing mortgage rates for new home purchases. This has boosted property sales activity, says Guo Shan of Hutong Research, a consultancy.

There are still dangers. The trade war is a drag on confidence. Home prices across 70 cities surveyed by the National Bureau of Statistics declined by about 2% in April from a month earlier. Sales of new homes and the starting and completion of housing projects all fell month on month. Fewer cities in April notched up month-on-month price rises compared with the month before. Things are not getting much worse but they will probably not get better without more government support, says Larry Hu of Macquarie, a bank.

In Wenzhou, a manufacturing city on China’s south-eastern coast, price declines are still sharp. Locals say the trade war with America is shaking confidence. Mr Zhou, a restaurant owner, says the official data do not capture huge discounts of more than 50% on some new homes in overbuilt areas. He blames a manufacturing downturn—and Mr Trump’s trade war.

In all probability the crisis is over in big rich cities, such as Shanghai, but may last longer in smaller cities, such as Wenzhou. New-home prices in first-tier cities will be flat this year and increase by 1% next year, according to S&P. But in third-tier cities and below they will fall by 4% this year and 2% next. Small cities are full of unwanted homes. China is escaping its property nightmare. Even so, the Communist Party must ensure it is not only big-ticket mansions in Shanghai that look appealing. ■

China is waking up from its property nightmare

An ecstatic $38m luxury-mansion auction lights up the market

Apartment blocks under construction in China.

Photograph: Getty Images

Jun 1st 2025|SHANGHAI

Save

Share

Give

Listen to this story

CHINA’S ECONOMY has been through a stress test in the past six months with the trade war shredding nerves. Tensions over tariffs are not over yet. On May 29th Scott Bessent, America’s treasury secretary, said that talks had “stalled”. President Donald Trump then exchanged accusations with China’s ministry of commerce about who had violated the agreement reached on May 12th to reduce duties. On June 4th, Mr Trump wrote on social media that President Xi Jinping was “extremely hard to make a deal with”. Yet even as the trade war staggers on, two things may be reassuring Mr Xi. One is that so far the economy has been resilient. Private-sector growth estimates for 2025 remain in the 4-5% range. The other is that one of China’s biggest economic nightmares seems to be ending: the savage property crunch.

To get a glimpse of that, consider a gated home in Shanghai’s Changning district. It has an air of traditional German architecture and a large front garden, a feature of the city’s most ritzy neighbourhoods. But what really stands out is the price. On May 27th the property sold for a stonking 270m yuan ($38m), creating a sensation in the Chinese press. At 500,000 yuan per square metre, it is one of the priciest home auctions in recent memory. That the wealthy are prepared to pony up such an exorbitant price is being interpreted as a sign that China’s huge and interminable property crisis might finally be ending.

Speculation about a turnaround has been building over dinner tables, in boardrooms and at state-planning symposiums. The excitement is hardly surprising. Property, broadly defined, contributed about 25% of GDP on the eve of its crash in 2020. It now represents 15% or less, showing how the slump has been a huge drag on GDP growth. The depressive impact of falling prices on ordinary folk is hard to overstate. In 2021, 80% of household wealth was tied up in real estate; that figure has fallen to around 70%. Hundreds of developers have gone bust, leaving a tangle of unpaid bills. The dampening of confidence helps explain sluggish consumer demand.

While the market is still falling, you can make a decent case for the first time since the start of the crisis that the end is in sight. In the first four months of 2025 sales of new homes by value fell by less than 3% compared with the year before. In 2024 the decline was 17%. Transactions will continue to drop only modestly this year, reckon analysts at S&P Global, a rating agency.

Chart: The Economist

One of the biggest problems was that millions of flats were built but never sold. Last year as many as 80m stood dormant. Now in the “tier-one” cities of Beijing, Shanghai, Guangzhou and Shenzhen, that problem is easing. At the end of January the inventory held by developers in those cities would have taken around twelve and a half months to shift at current sales rates, according to CRIC, a property data service. That is down from nearly 20 months in July 2024, and not far from the average of ten months in 2016-19 across the country’s 100 largest cities. In other words, the overhang is starting to look less terrifying.

Shanghai’s renaissance illustrates the trend. Transactions rose slightly each month from February to April compared with the year before, making it one of the few cities where prices have risen year on year for months in a row. It still has controls over who can buy properties and how many. But luxury homes are starting to be snapped up quickly, says Ms Fang, an estate agent. The prices of standard properties will probably continue to grow this year, she says, but the most expensive homes are increasing in value even faster.

Bottoms up

What explains the bottoming out? Partly, just the passage of time. The average housing crash takes four years to play out, according to a study by the IMF of house-price crashes from 1970 to 2003. Officials in Beijing started deflating the bubble by tightening developers’ access to credit in mid-2020 and investors started to panic about the solvency of the monster developers at the end of that year. But the government is also more determined than ever to put an end to the downturn. Local governments have been encouraged to buy unused land and excess housing with proceeds from special bonds. Some are handing out subsidies for buying homes. A plan to renovate shantytowns could create demand for 1m homes. The central bank cut interest rates in May, reducing mortgage rates for new home purchases. This has boosted property sales activity, says Guo Shan of Hutong Research, a consultancy.

There are still dangers. The trade war is a drag on confidence. Home prices across 70 cities surveyed by the National Bureau of Statistics declined by about 2% in April from a month earlier. Sales of new homes and the starting and completion of housing projects all fell month on month. Fewer cities in April notched up month-on-month price rises compared with the month before. Things are not getting much worse but they will probably not get better without more government support, says Larry Hu of Macquarie, a bank.

In Wenzhou, a manufacturing city on China’s south-eastern coast, price declines are still sharp. Locals say the trade war with America is shaking confidence. Mr Zhou, a restaurant owner, says the official data do not capture huge discounts of more than 50% on some new homes in overbuilt areas. He blames a manufacturing downturn—and Mr Trump’s trade war.

In all probability the crisis is over in big rich cities, such as Shanghai, but may last longer in smaller cities, such as Wenzhou. New-home prices in first-tier cities will be flat this year and increase by 1% next year, according to S&P. But in third-tier cities and below they will fall by 4% this year and 2% next. Small cities are full of unwanted homes. China is escaping its property nightmare. Even so, the Communist Party must ensure it is not only big-ticket mansions in Shanghai that look appealing. ■

-

一紙荒唐(阿糖)楼主

- 论坛精英

- 帖子互动: 395

- 帖子: 6929

- 注册时间: 2025年 2月 8日 09:23

- 来自: 没能耐就说没能耐,什么叫大环境不好?你到哪哪大环境不好,你是破坏大环境的人啊? -赵本山

#2 Re: China is waking up from its property nightmare

我认为... 国内的房地产基本到底了...

经济学人这篇文章说北上广一线城市触底气象非常明显...

二三线城市 可能还没完全到底...

但对于想要回国养老的将军们...

是时候可以看房子了...

我认为中国的房地产别指望他像从前那样涨... 那个时代己过去了

只要stable 就可以了 反正是老帮菜 回去养老...

老帮菜 不必去了一线城市 北上广

找一个生活舒适 各方面条件不错的二三线城市就行

经济学人这篇文章说北上广一线城市触底气象非常明显...

二三线城市 可能还没完全到底...

但对于想要回国养老的将军们...

是时候可以看房子了...

我认为中国的房地产别指望他像从前那样涨... 那个时代己过去了

只要stable 就可以了 反正是老帮菜 回去养老...

老帮菜 不必去了一线城市 北上广

找一个生活舒适 各方面条件不错的二三线城市就行

x1

#4 Re: China is waking up from its property nightmare

没用, 经济基本面这个熊样,降薪失业弥漫全国, 人口持续萎缩,现在抄底只能抄成接盘侠

好日子还在后头呢!

-

一紙荒唐(阿糖)楼主

- 论坛精英

- 帖子互动: 395

- 帖子: 6929

- 注册时间: 2025年 2月 8日 09:23

- 来自: 没能耐就说没能耐,什么叫大环境不好?你到哪哪大环境不好,你是破坏大环境的人啊? -赵本山

#9 Re: China is waking up from its property nightmare

骂街没意思的... 这是文章里的插图...

中国的房地产... 大概率的软着陆了... 痛苦的七八年后.

其实现在中国的房地产的泡沫已不大了...

看看三哥的房地产... 其泡沫大的惊人

一旦爆破 咖哩味可能会充满全球

#11 Re: China is waking up from its property nightmare

回帖看空的越多越好,一二线已经可以慢慢抄底了。一紙荒唐 写了: 2025年 6月 8日 14:13 我认为... 国内的房地产基本到底了...

经济学人这篇文章说北上广一线城市触底气象非常明显...

二三线城市 可能还没完全到底...

但对于想要回国养老的将军们...

是时候可以看房子了...

我认为中国的房地产别指望他像从前那样涨... 那个时代己过去了

只要stable 就可以了 反正是老帮菜 回去养老...

老帮菜 不必去了一线城市 北上广

找一个生活舒适 各方面条件不错的二三线城市就行

x1

#14 Re: China is waking up from its property nightmare

到个鸡吧底,县城房子好几千一平米,县城蝼蚁唯一的收入就是外出打工,现在没工打了,就是一千块钱也供不起。这些房子根本没有底,其他三四线城市一样

-

一紙荒唐(阿糖)楼主

- 论坛精英

- 帖子互动: 395

- 帖子: 6929

- 注册时间: 2025年 2月 8日 09:23

- 来自: 没能耐就说没能耐,什么叫大环境不好?你到哪哪大环境不好,你是破坏大环境的人啊? -赵本山

#18 Re: China is waking up from its property nightmare

那是养老房... 没人指望它赚钱或大富大贵. 懂吧!

再说了... 万一草台班子发疯要把你送到集中营...

你在国内还有个落脚的地方 躲一躲! OK?

另外也不需要多少钱... 10万刀... 大概就够了

-

Blackjack21(Blackjack)

- 职业作家

- 帖子互动: 61

- 帖子: 573

- 注册时间: 2023年 1月 11日 11:02