🕰 Cisco in 2000:

Fueled by the internet gold rush.

Every business was getting online; Cisco sold the critical hardware.

Its market cap peaked near $555B in March 2000.

Valuation metrics (like P/E ratio) became stretched.

After the dot-com crash, revenue slowed and the stock collapsed ~80%.

Cisco remained a strong company but stopped being seen as "transformational."

Central to the AI gold rush, especially with LLMs (ChatGPT, Claude, Gemini).

Nvidia chips power everything from cloud AI to robotics to autonomous vehicles.

The company has built a full stack: hardware (GPUs), networking (Mellanox), and software (CUDA, Nvidia AI Enterprise).

Valuation is high (~$3 trillion+), but backed by huge revenue and profit growth.

Risks: over-reliance on hyperscalers, rising competition, AI capex normalization, geopolitical supply chain issues.

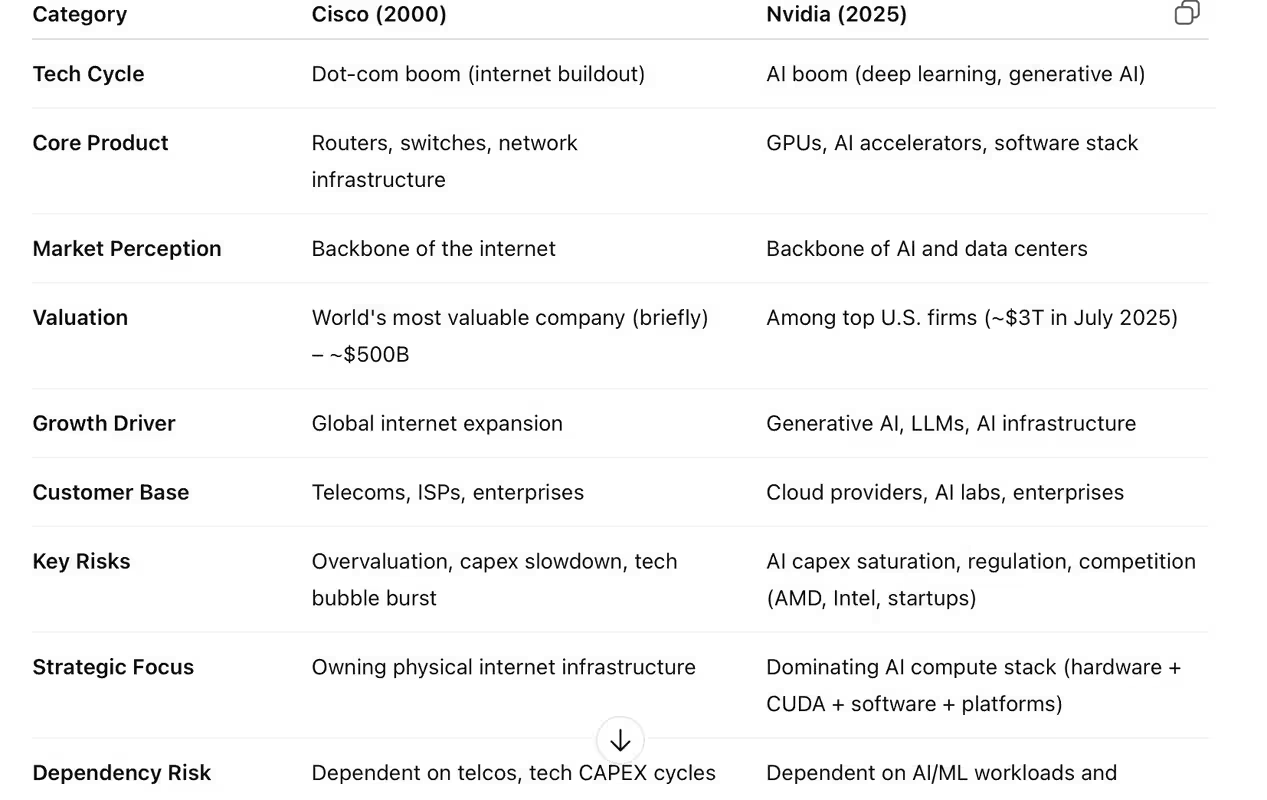

Nvidia in 2025 resembles Cisco in 2000 in that:

Both were/are seen as essential tech enablers of their era.

Each rode a massive macro tech trend (Internet for Cisco, AI for Nvidia).

Each hit massive valuations as a result.

But Nvidia may be more defensible due to:

Stronger margins (software leverage).

Greater vertical integration (hardware + software).

More diverse use cases (beyond just cloud).