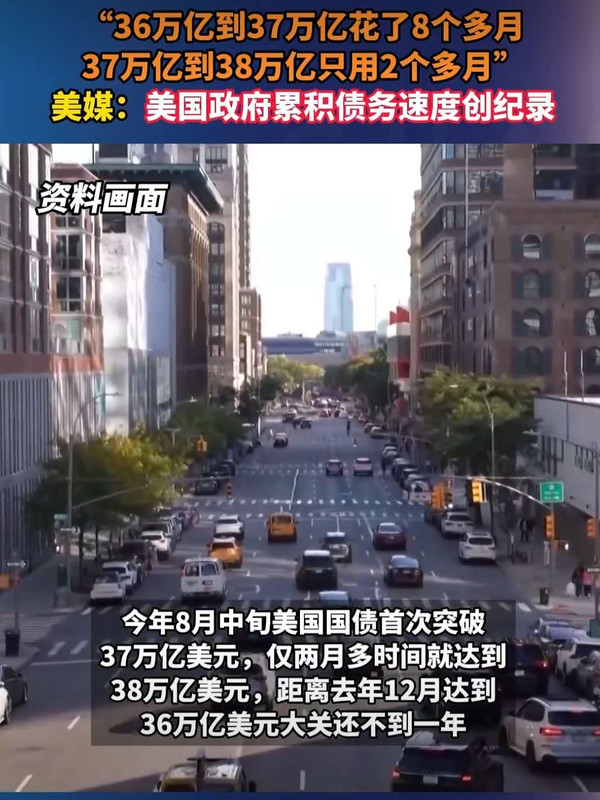

The U.S. national debt has surged past $38 trillion, according to the U.S. Treasury Department, just two months after surpassing previous forecasts to reach $37 trillion in August. This means the federal debt rose by $1 trillion in a little over two months, which the Peter G. Peterson Foundation calculates is the fastest rate of growth outside the pandemic.

Michael A. Peterson, CEO of the nonpartisan watchdog dedicated to fiscal sustainability, said this landmark is “the latest troubling sign that lawmakers are not meeting their basic fiscal duties.” In a statement provided to Fortune, Peterson said that “if it seems like we are adding debt faster than ever, that’s because we are. We passed $37 trillion just two months ago, and the pace we’re on is twice as fast as the rate of growth since 2000.” The foundation’s analysis attributes the acceleration to a combination of deficit spending, rising interest costs, and the economic drag of the ongoing government shutdown.

Expand article logo Continue reading

Peterson emphasized that the costs of carrying this debt are mounting rapidly. Interest payments on the national debt now total roughly $1 trillion per year, the fastest-growing category in the federal budget. Over the last decade, the government spent $4 trillion on interest, and Peterson calculated that it will balloon to $14 trillion over the next 10 years. He said that money “crowds out important public and private investments in our future.”