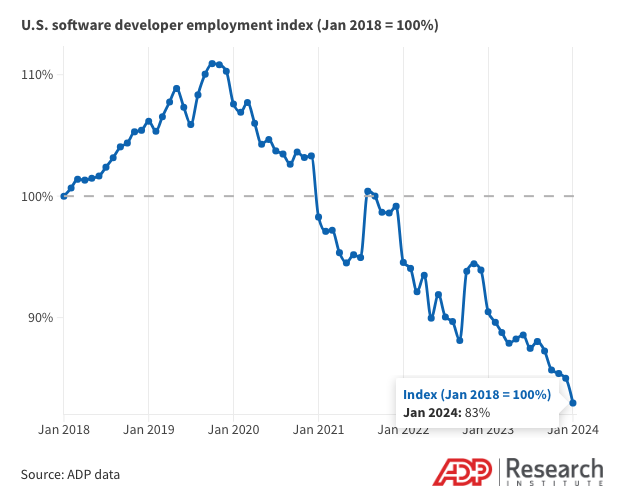

软件工程师工作的下行趋势

版主: hci

#7 Re: 软件工程师工作的下行趋势

FED是为了控制inflation才加的息。高利率会导致business以及私人贷款cost大大增加;budget减少,公司就会减招甚至裁员。high earners少了,能花钱的少了,就会帮助降低inflation

As of May 2024, interest rates remained high while inflation had decreased, which has been called a white-collar recession. The white-collar job market has been experiencing a slowdown, with hiring rates for high-earners dropping significantly since 2022 compared to lower-paying roles. Some say that when budgets are tight, employers are less likely to hire more expensive workers

As of May 2024, interest rates remained high while inflation had decreased, which has been called a white-collar recession. The white-collar job market has been experiencing a slowdown, with hiring rates for high-earners dropping significantly since 2022 compared to lower-paying roles. Some say that when budgets are tight, employers are less likely to hire more expensive workers

+1.00 积分 [版主 hci 发放的奖励]

看不懂脸色、分不清局势、见不惯人心,三者得其一,便是取祸之道

#9 Re: 软件工程师工作的下行趋势

减息公司就能有更多的budget,做更多的project。某些project只有在美国能做,也只能在美国招人。因为印度teams缺乏相应的background和skills,他们再便宜,做的太慢甚至做不出来,也是不行的

看不懂脸色、分不清局势、见不惯人心,三者得其一,便是取祸之道

#12 Re: 软件工程师工作的下行趋势

软件公司坐在一堆cash 上,借个p 钱,反而赚了很多利息capital gainhelpme 写了: 2024年 6月 18日 07:50 FED是为了控制inflation才加的息。高利率会导致business以及私人贷款cost大大增加;budget减少,公司就会减招甚至裁员。high earners少了,能花钱的少了,就会帮助降低inflation

As of May 2024, interest rates remained high while inflation had decreased, which has been called a white-collar recession. The white-collar job market has been experiencing a slowdown, with hiring rates for high-earners dropping significantly since 2022 compared to lower-paying roles. Some say that when budgets are tight, employers are less likely to hire more expensive workers

#15 Re: 软件工程师工作的下行趋势

你这有点business盲了,如果利率足够低,大公司能借银行的钱来赚钱,它自己有多少cash也乐意呀,不借白不借:“

Large companies like Apple may take loans even when they make large profits for several reasons:

Tax Efficiency: Interest payments on loans are often tax-deductible. By taking on debt, companies can reduce their taxable income, which can result in lower tax payments. This can be a more tax-efficient way to manage their finances compared to using their profits directly

Cash Flow Management: Even though a company may be highly profitable, its profits may not always be immediately available as cash. Taking on a loan can provide the company with additional cash flow to fund operations, investments, or other financial obligations without having to liquidate assets or use their available cash reserves

Capital Structure Optimization: Companies often aim to strike a balance between debt and equity in their capital structure. By taking on debt, companies can leverage their equity to potentially achieve higher returns for shareholders. Additionally, maintaining a mix of debt and equity can help companies optimize their cost of capital

Investment Opportunities: Large companies like Apple may have opportunities for growth or investment that require significant capital outlays. By taking on debt, they can finance these investments without depleting their cash reserves or impacting their day-to-day operations

Stock Buybacks and Dividends: Companies may use debt to fund stock buyback programs or pay dividends to shareholders. This can be a way to return value to shareholders without using up all of the company's cash reserves

Low Interest Rates: If interest rates are low, companies may find it attractive to borrow money at favorable rates to fund their activities or investments. This can be a cost-effective way to raise capital, especially when borrowing costs are low

Financial Flexibility: By having access to credit lines or loans, companies can maintain financial flexibility and have a cushion of liquidity in case of unforeseen circumstances or opportunities that may arise in the future

”

Large companies like Apple may take loans even when they make large profits for several reasons:

Tax Efficiency: Interest payments on loans are often tax-deductible. By taking on debt, companies can reduce their taxable income, which can result in lower tax payments. This can be a more tax-efficient way to manage their finances compared to using their profits directly

Cash Flow Management: Even though a company may be highly profitable, its profits may not always be immediately available as cash. Taking on a loan can provide the company with additional cash flow to fund operations, investments, or other financial obligations without having to liquidate assets or use their available cash reserves

Capital Structure Optimization: Companies often aim to strike a balance between debt and equity in their capital structure. By taking on debt, companies can leverage their equity to potentially achieve higher returns for shareholders. Additionally, maintaining a mix of debt and equity can help companies optimize their cost of capital

Investment Opportunities: Large companies like Apple may have opportunities for growth or investment that require significant capital outlays. By taking on debt, they can finance these investments without depleting their cash reserves or impacting their day-to-day operations

Stock Buybacks and Dividends: Companies may use debt to fund stock buyback programs or pay dividends to shareholders. This can be a way to return value to shareholders without using up all of the company's cash reserves

Low Interest Rates: If interest rates are low, companies may find it attractive to borrow money at favorable rates to fund their activities or investments. This can be a cost-effective way to raise capital, especially when borrowing costs are low

Financial Flexibility: By having access to credit lines or loans, companies can maintain financial flexibility and have a cushion of liquidity in case of unforeseen circumstances or opportunities that may arise in the future

”

看不懂脸色、分不清局势、见不惯人心,三者得其一,便是取祸之道

#16 Re: 软件工程师工作的下行趋势

不能给公司带来经济效益的职位都是CHOPPING BLOCK

这都是血的教训,今天公司来了几个INTERN,搞得还

挺忙的,要他们三个月搞出个PROJECT,要求还挺高

#17 Re: 软件工程师工作的下行趋势

laomei9 写了: 2024年 6月 18日 17:53 不能给公司带来经济效益的职位都是CHOPPING BLOCK

这都是血的教训,今天公司来了几个INTERN,搞得还

挺忙的,要他们三个月搞出个PROJECT,要求还挺高

招 intern 基本都是公司倒贴很多钱的。首先要为这堆人一大堆系统设置,权限,办公又是一帮开销。中间要辅导这些人,白白占用老员工时间。最后做 presentation,又是老员工的时间进去

#18 Re: 软件工程师工作的下行趋势

是的,不过公司也挺精明的,10个INTERN将来有一个来的,就是赚的zmz123 写了: 2024年 6月 18日 19:15 招 intern 基本都是公司倒贴很多钱的。首先要为这堆人一大堆系统设置,权限,办公又是一帮开销。中间要辅导这些人,白白占用老员工时间。最后做 presentation,又是老员工的时间进去

现在的马工不好招,聪明能干的,这种刚毕业快毕业的要价也低,

都是好学校的,等于是试用了,公司长期都要招人,逮着一个算一个,

差的不要。

x1

#19 Re: 软件工程师工作的下行趋势

属实。我司最得力的员工就是intern转正的。

laomei9 写了: 2024年 6月 18日 19:45 是的,不过公司也挺精明的,10个INTERN将来有一个来的,就是赚的

现在的马工不好招,聪明能干的,这种刚毕业快毕业的要价也低,

都是好学校的,等于是试用了,公司长期都要招人,逮着一个算一个,

差的不要。