那这部分W2还可以找payroll更改吗?

自己再补足当年的SSN Tax。

求教:低收入者的年金计算和自己退休金的影响?

#25 Re: 求教:低收入者的年金计算和自己退休金的影响?

Social security is earned by tax payers who paid into it and is termed the third rail of US politics (touch it and die, although it had been modified over the years). SSI is aimed to help the poorest of the US poors who can't live just with SS alone but the donkeys have extended it way beyond its original purpose.

#27 Re: 求教:低收入者的年金计算和自己退休金的影响?

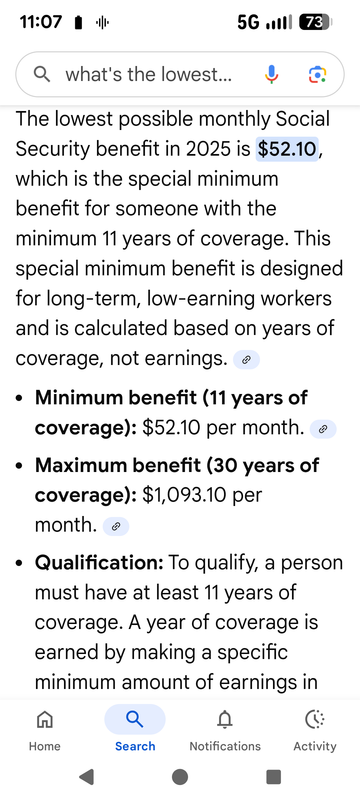

理论上讲,如果你预期退休前ss tax的总taxable income超过52万就没必要补缴。就是说按35年算,平均每年报税收入一万五就好了。当然点数要够40点。这一部分是在90%的计算范围里,就是说报一块钱的收入,社安金会发9毛。超过部分只match0.32或更少

我欲乘机归去,又恐穷楼鬱府,高处不能酣

#28 Re: 求教:低收入者的年金计算和自己退休金的影响?

没有交足social security tax的这个问题很严重的,会被罚款,补缴利息和法律问题的

如果你的工作是政府宗教或者其他机构,你不用交social security tax.

————————

Underpaying Social Security tax (FICA tax) can result in significant IRS penalties, interest charges, and potential legal action, including criminal prosecution in cases of willful evasion. The exact consequences depend on whether the underpayment was a genuine error or intentional, and whether you are an employee, a self-employed individual, or an employer

#29 Re: 求教:低收入者的年金计算和自己退休金的影响?

sp500 写了: 2025年 11月 5日 11:36没有交足social security tax的这个问题很严重的,会被罚款,补缴利息和法律问题的

如果你的工作是政府宗教或者其他机构,你不用交social security tax.

————————

Underpaying Social Security tax (FICA tax) can result in significant IRS penalties, interest charges, and potential legal action, including criminal prosecution in cases of willful evasion. The exact consequences depend on whether the underpayment was a genuine error or intentional, and whether you are an employee, a self-employed individual, or an employer

SSN tax每年的我都交了。

只是有几张W2在SS box预扣是0. 这估计要去office询问了。。。