LEARN MORE By Bloomberg News

January 15, 2024 at 7:00 AM EST

For the first time, China exported more to Southeast Asia than the US last year, highlighting the realignment of global trade that’s happening as the economic relationship frays between Washington and Beijing.

The 10 nations in Asean bought $524 billion of goods last year, higher than the $500 billion worth sold to the US or the value of shipments to the European Union, data released Friday showed.

Asean is Now China's Biggest Export Destination

Exports to the EU were also slightly higher than to the US last year

Source: China's General Administration of Customs

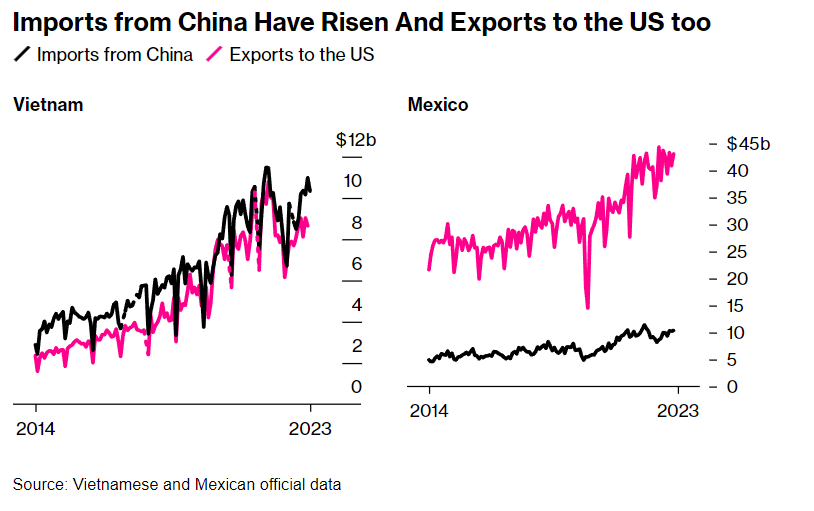

But while the data show a slow decoupling happening between China and the US, it’s not a clean breakup. Chinese exports to Mexico were up more than 5% through November, with companies likely shipping some products there for final sale in the US, avoiding US tariffs.

Big Take: War Over Taiwan Is a $10 Trillion Risk to the Global Economy

Exports to Thailand and Vietnam also fell much less than elsewhere. Chinese and foreign firms have increasingly been shipping goods there to be finished and then re-exported to developed nations, with the Bank of International Settlements writing about these “elongated supply lines” last year.

Imports from China Have Risen And Exports to the US too

Source: Vietnamese and Mexican official data

Sustained deflation in China is also dragging down the value of Chinese exports and making them cheaper for foreign consumers. In October, the index of export prices hit the lowest in data back to 2006, and was only slightly higher in November.

Read More: China’s Central Bank Holds Key Rate in Policy Surprise

One cause of that drop in prices has been the slowing domestic economy, which has has also weighed on imports of goods such as semiconductors — down by double digits last year.

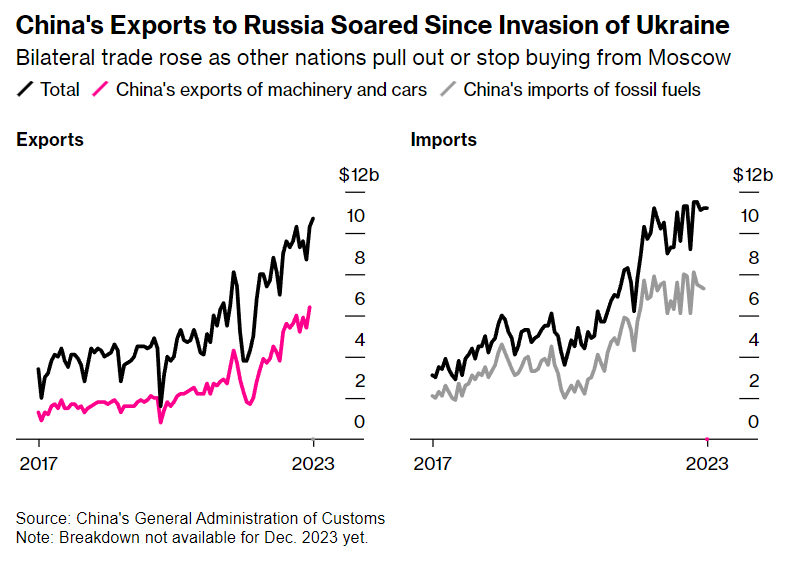

China's Exports to Russia Soared Since Invasion of Ukraine

Bilateral trade rose as other nations pull out or stop buying from Moscow

Source: China's General Administration of Customs

Note: Breakdown not available for Dec. 2023 yet.

One big standout was trade with Russia, with exports up almost 50% and imports rising almost 13%. Chinese companies have taken advantage of competitors from elsewhere pulling out of the country and piled in, selling many more cars and other machinery.

At the same time, Chinese imports are well above the level when Russia invaded Ukraine, with Beijing buying more oil and gas from its northern neighbor.

Related Reading:

Xi Stays Clear of Red Sea Battle Despite Risks to China Trade

China Chip Imports Suffer Steepest Drop on Record After US Curbs

Baidu Sinks Most Since 2022 Despite Denying Links to PLA AI

Odd Lots Podcast: The Economic Impact If China Invades Taiwan

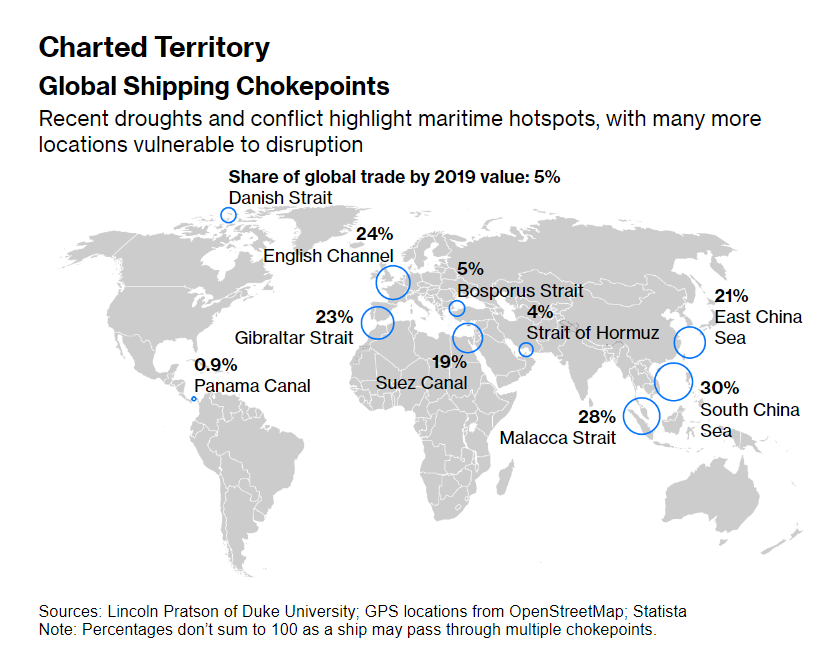

Charted Territory

Global Shipping Chokepoints

Recent droughts and conflict highlight maritime hotspots, with many more locations vulnerable to disruption

Sources: Lincoln Pratson of Duke University; GPS locations from OpenStreetMap; Statista

Note: Percentages don’t sum to 100 as a ship may pass through multiple chokepoints.

Mapping Chokepoints | Thousands of miles from Suez and Panama, waterways that carry large swathes of global commerce are vulnerable to disruptions that will shake up supply chains, according to research by Professor Lincoln Pratson at Duke University’s Nicholas School of the Environment. According to Bloomberg Opinion columnist Tim Culpan, Pratson painstakingly details trade patterns, shipping routes and the shortest paths across the oceans to assess the potential impact of closing any of the 13 chokepoints he identified around the world.

Today’s Must Reads

US fighter aircraft shot down a cruise missile fired from a Houthi militant area of Yemen toward a Navy destroyer operating in the southern Red Sea. Meanwhile, Qatar appears to have paused sending liquefied natural gas tankers through the Bab el-Mandeb Strait after US-led airstrikes on Houthi targets in Yemen raised risks in the vital waterway.

UK trade with the European Union is holding up better than expected — but that’s a result of lackluster activity with the rest of the world rather than any Brexit-defying boost to business with Europe, official data indicates.

US Trade Representative Katherine Tai visited India for talks with the country’s trade and foreign ministers on topics including business visas for Indian workers and duty-free access on goods.

Hyundai will give as much as $7,500 in cash bonuses for electric-vehicle buyers in the US, seeking to keep its cars competitive with automakers qualifying for tax credits under President Joe Biden’s Inflation Reduction Act.

Plagued by ongoing staffing shortages, visa delays and even political division, the US travel industry has lagged competitors in reclaiming its share of international visitors since the Covid-19 pandemic.

This episode of the Big Take podcast explains how the Panama Canal is contending with a crippling drought, worsened by climate change and infrastructure constraints. Meanwhile, The cost that shipping companies pay to jump ahead of congestion around the waterway has dropped from multimillion-dollar record highs.

On the Bloomberg Terminal

Conflict in the Red Sea has driven container rates higher for carriers including Maersk as vessels avoid the Suez Canal and use the Cape of Good Hope. This has helped absorb significantly slack liner capacity and should help mitigate losses for the year, Bloomberg Intelligence says.

Lingering China-US trade tensions could spur more overseas investments by Chinese pulp importers in countries such as Indonesia and Finland, according to Bloomberg Intelligence.

Run SPLC after an equity ticker on Bloomberg to show critical data about a company's suppliers, customers and peers.

Use the AHOY function to track global commodities trade flows.

For freight dashboards, see {BI RAIL}, {BI TRCK} and {BI SHIP} and {BI 3PLS}

Click HERE for automated stories about supply chains.

On the Bloomberg Terminal, type NH FWV for FreightWaves content.

See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

Like Supply Lines?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish the New Economy Daily, a briefing on the latest in global economics.

For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.

中国产业链会留在中国,两个系统之间有一定的交流

但是不占主流

不需要为了多出口俄罗斯而进口更多没用的葡萄酒皮包等东西

法国 英国 意大利 德国加起来就比俄国多不少