美国总体经济是好的,AI有泡沫,但也并非那么虚,没法和去年那样带来大涨,但大跌可能性也很小。

我觉得今年应该就是在5000-6300之间波动

[3月13日更新]

1. the selloff pressure is easing。二月sp500到最高点 6147,接着第一周开始下跌,最低跌倒5837,跌幅-5.04%,第二周最低点是5666,跌幅-2.94%,第三周本周,最低是今天 5504,跌幅-2.78%。虽然一直在跌,但抛售压力正在减弱,下周应该还是跌。但我感觉过两周,市场可能就会盘整或尝试反弹。

2. 为什么Fed加息和贸易战不同呢?

股市进入熊市,通常需要持续且明确的因素导致资金流出。例如,2022年Fed连续十次加息,清晰地引导投资者转向其他金融市场。投资者的恐慌性抛售在股市中并不少见,但如果没有实质性且持久的利空因素,资金往往会回流。

那么,为什么Trump的贸易战不是持续的利空因素呢?在经济状况良好的前提下,投资者容易适应他的政治举措,信心也会随之恢复。Trump在第一任期内也各种折腾,股市只是受到短期影响,更多是板块轮动,任期四年,SP500总体涨了68%。

2022年的熊市本质上是货币政策直接引导资金流出股市的结果,这与投资者信心波动导致的短期调整有根本区别。加息政策改变了整个投资环境的基础参数,而贸易政策主要影响特定行业和市场情绪。

3. AI泡沫破裂进入熊市?

AI不是泡沫,AI有过热的地方,但同时也是真正在各行各业提高生产效率。麦肯锡的数据“Our latest research estimates that generative AI could add the equivalent of $2.6 trillion to $4.4 trillion annually across the 63 use cases we analyzed—by comparison, the United Kingdom’s entire GDP in 2021 was $3.1 trillion. ”

[3月14日更新]

The SP 500 is bouncing back with resilience, signaling renewed investor confidence. If the momentum holds, 5600 could act as a solid support level.

[3月17日更新]

The SP500 bouncing back to 5,600 is a positive sign, but I’m not overly optimistic just yet. The market seems to be stabilizing. However, with the Fed’s talk tomorrow, we could see some turbulence. They’re unlikely to change rates, but their tone matters—if they hint at high rates sticking around or signal weak economic growth, the market could react negatively. Add in inflation concerns and Trump’s tariff uncertainty, and it wouldn’t be surprising to see a pullback to 5,500-5,550 as traders take profits. That said, this isn’t a crash—just normal market noise. The slowing pace of decline in recent weeks and positive geopolitical news, like the Ukraine truce, suggest that a bottom is forming. The Fed might shake things up in the short term, but the overall recovery trend is still intact.

[3月19日更新]

Can We Hold 5700?

The SP500 just smashed through 5700, fueled by Powell’s recession-free outlook. Traders clearly loved it, but now the question is—can we hold this level? A pullback is always possible, but momentum is strong, and if buyers keep stepping in, 5800 might not be far off. This rally isn’t running out of steam yet.

[3月24日更新]

Trump即使实施所有他的关税政策,美国的经济前景依旧会好,因为关税仅仅是他全部经济政策的一小部分,他的其它政策会抵消关税的负面作用。

Trump第一任期SP500涨了68%,尽管当时的政治政策一样不利于稳定投资者信心。但他2017TCJA大幅度对企业减税,对企业的监管减少。干预Fed的货币政策等等,总体让美国经济稳健增长。

美国经济总体很稳健,但今年缺乏像去年一样的AI刺激力量。今年不会是牛市也不会是熊市。

[5月12日更新]

教科书对bear/bull market的定义是跌幅/涨幅超过20%,在这个之间的,叫做sideways market(或者非正式叫法crab market)

[5月14日更新]

为什么我比版上的熊熊们预判的更准确,因为我比你们更了解Trump。版上有几个人认真读过他写的 The Art of the Deal?认真读过你就知道,虚张声势是他一贯的获利手法。操控对手的心理,增加手里虚拟筹码,获得更多利润,他把这个叫做truthful hyperbole。这个关税战他还会继续玩,但不管怎么玩,他不会让实体经济受损的,你们去看看他第一任期的经济情况就知道第二任期会怎么走了。

[5月16日更新]

Can we hit 6,000 next week?

The SP 500’s been grinding higher and is now knocking on the door of 6,000. Personally, I think it might pop through next week. Everything’s kinda lining up.

A few months ago, investors were hoping the Fed would start cutting rates by mid-2025, but inflation just hit a four-year low in April, and now the Fed seems happy to keep things steady. That stability is probably what the market needs right now.

Earnings? Way better than expected. Q1 numbers came in hot: 12 to 13% growth for SP 500 companies. That’s solid. And investor sentiment is in a healthy zone too: about 36% bullish, which is right around the long-term average. So we’re not seeing the kind of overconfidence that often leads to a reversal.

Geopolitics? Things seem to be calming down. The Trump tariff noise has mostly faded, and I see it more as a bluff than a real threat, and markets seem to agree. Other global tensions, like the Russia-Ukraine conflict, aren’t really shaking investors at the moment.

Put it all together: cooling inflation, strong earnings, stable Fed policy, and calm geopolitics. And the market has room to run. Will we break 6,000 next week? I think it’s likely, though there might be a little hesitation right at the line. Either way, we’re getting close.

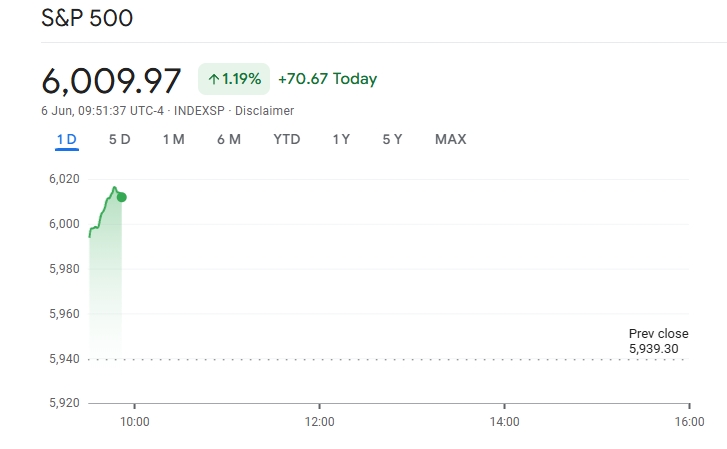

[6月6日更新]

嘻嘻,不出所料,回到6000啦~ 但我不看好它能冲很高。如我年初分析的,今年经济总体良好,但也不算太好:就业市场降温,消费者信心指数在健康范围内上下波动,ISM 制造业指数和生产指数都中上水平。这种情况下,下半年股市应该会继续随着各种消息下上下震荡,但因为基本面良好,市场反应并不会剧烈到有重大改变,形成跌幅/涨幅超过20%的熊市或者牛市。应该就是我年初说的大概在5000-6300之间波动。

-----

Disclaimer: 我从来没有炒过股,连交易账户都没有。因为研究课题涉及股市,知道一些理论的东西。所以,瞎猜的哈

I don’t have any stock market positions—my predictions are purely out of academic interest. I don’t trade, so whether the market goes up or down, I’m just here to analyze the trends.